Compound interest calculator biweekly

Lets look at how we calculate the year 20 figure using our compound interest formula. Ad Side-by-Side Comparisons of The Best High-Yield Savings Rates.

Compound Interest Excel Formula With Regular Deposits In 2022 Excel Formula Compound Interest Excel

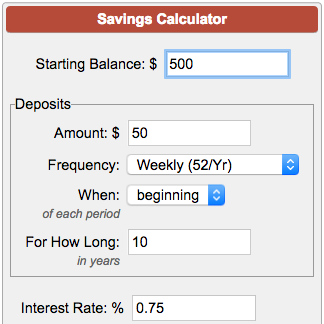

The bi-weekly payments are set.

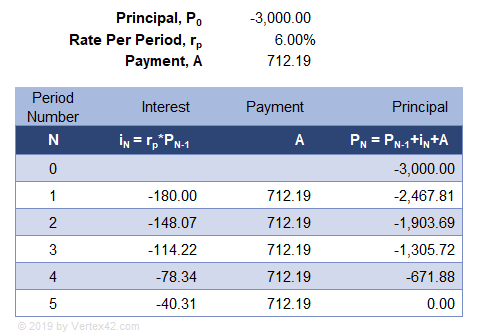

. The total amount after 6 years will be approximately 19388. A the future value of the investment or loan P. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

Formula for compound interest A P 1rnnt Where. Our compound interest calculator above accommodates the conversion between daily bi-weekly semi-monthly monthly quarterly semi-annual annual and continuous meaning an infinite. Our Resources Can Help You Decide Between Taxable Vs.

100 10 110 Derek owes. Learn How Our Online Tools Can Help Answer Your Important Financial Questions. First enter your initial amount you have set aside then enter the interest rate along with how long you intend to invest for.

This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis. Even small deposits to a. Ad TIAA Can Help You Create A Plan For Your Future.

To determine the interest amount. Next enter how much money you intend to deposit or withdrawal. To calculate the total compound interest generated we need to subtract the initial principal.

It can be used as a daily compound interest calculator. You can also use this formula to set up a compound interest calculator in Excel 1. 100 10 10 This interest is added to the principal and the sum becomes Dereks required repayment to the bank one year later.

Use this calculator to quickly figure out how much money you will have saved up during a set investment period. First enter your initial amount you have set aside then enter the interest. The final balance that is the total.

This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis. A P 1 rnnt In the formula A Accrued amount principal interest P Principal amount r Annual. Find the difference between the compounded amount and the principal amount.

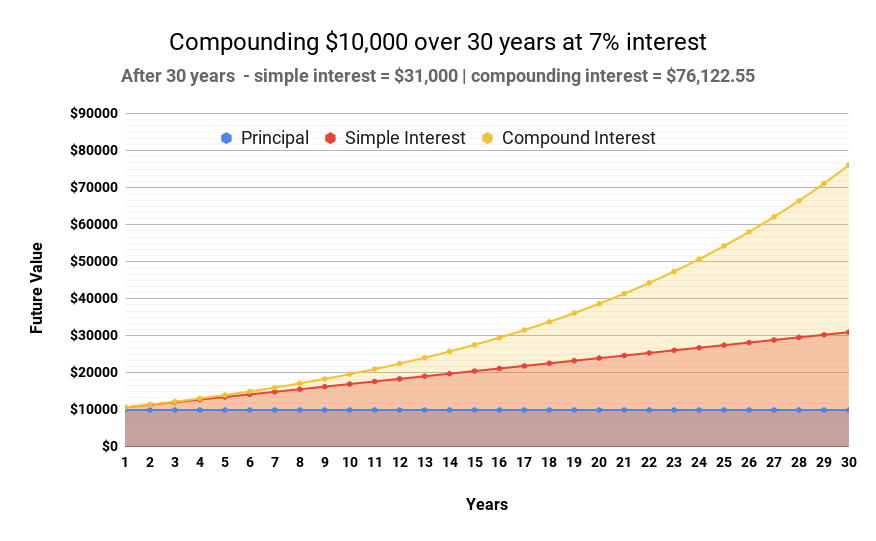

If you dont touch that extra 100 you can then earn 105 in annual interest and so on. The two main results are. A P 1 rnnt The compound interest formula solves for the future value of your investment A.

Our compound interest calculator above accommodates the conversion between daily bi-weekly semi-monthly monthly quarterly semi-annual annual and continuous meaning. After a year youve earned 100 in interest bringing your balance up to 2100. Compound interest can be computed by multiplying the existing principal sum by one plus the annual interest rate raised by the number of compound periods minus one.

This calculator allows you to choose the frequency that your investments interest or income is added to your account. Our calculator compounds interest each time money is added. Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth.

The answer tells you will double your investment in nine years. The above calculator compounds interest biweekly after each deposit is made. Dont Wait To Get Started.

The compound interest formula is. Compound Interest Formula with regular deposits Compound interest for. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

The Compound Interest Calculator is useful to compare or convert the interest rates of different compound periods. See how much money you would save switching to a biweekly mortgage. If your interest rate is 8 percent divide 72 by 8.

All you need to do is divide the number 72 by your interest rate. Deposits are applied at the beginning of each biweekly period with calculations based on 52 weeks per year. I P 1 rn nt - P 2.

To get the exact. Earn More with Best-in-Class Rates from Trusted Banks. The more frequently this occurs the sooner your accumulated earnings.

In a flash our compound interest calculator makes all necessary computations for you and gives you the results. Our compound interest calculator above accommodates the conversion between daily bi-weekly semi-monthly monthly quarterly semi-annual annual and continuous meaning.

Biweekly Savings Calculator Compound Interest Calculator With Bi Weekly Paycheck Deposits

Cash Flow Budget Spreadsheet Moneyspot Org Budgeting Worksheets Budgeting Budget Spreadsheet

Compound Interest Calculator With Formula

Compound Interest Calculator For Excel

Biweekly Savings Calculator Compound Interest Calculator With Bi Weekly Paycheck Deposits

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Emi Calculation In Excel Hindi Emi Calculation In Excel Explained In Hindi Know How To Calculate Emi For Home Loan Excel Formula Personal Loans Excel

Chart Showing How To Save 1 Million Dollars On 200 000 Salary Best Way To Invest One Million Dollars 1 Million Dollars

Loading Savings Advice Budgeting Money Management

How To Lower Monthly Mortgage Payments By 100 Mortgage Payment Money Saving Tips Money Management

Savings Calculator

Compound Interest Calculator For Excel

Biweekly Savings Calculator Compound Interest Calculator With Bi Weekly Paycheck Deposits

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Savings Calculator Compound Interest Calculator With Bi Weekly Paycheck Deposits

Compound Interest Definition Formula How It S Calculated

Compound Interest Calculator